Investor Resources

Investor Resources

Expensify Investor FAQ

Expensify Investor FAQ

Hello public investor! Here's some additional information about EXFY that we thought you would find helpful. For your convenience, we've broken everything up into some high level sections, with the most common questions in each at the top – with the common followup questions under each. Ain't got time to read through all this? No problem: just email your questions to investors@expensify.com, and we'll get you sorted!

Table of Contents

What's new?

Last updated 2023-12-11

New Expensify

New Expensify was selected as the networking platform for the 10,000 attendees at the SaaStr Annual Global conference hosted in September! This partnership was a huge success for us and we look forward to New Expensify expanding to more conferences in 2024.

While attending Money20/20 in October 2023, we announced our expansion into the consumer payments space by introducing our latest innovation: Bill Split in New Expensify. Utilizing the Expensify Wallet users can split a bill, request and send money, and chat across a group all in one app. Expensify is more than just business expenses management—it's a fully fledged financial super-app you can use both at work and at home.

The Expensify Card

Starting in September 2023, Accounting Partners who onboard clients to the Expensify Card may receive 50 basis points in revenue share for their clients. This offer is further strengthening our presence in the accounting channel.

Net interchange derived from the Expensify Card increased 16% quarter over quarter (compared to Q2 2023) and 65% year over year (compared to Q3 2022).

New Feature: Insights

In Q3'23 we announced the release of enhanced insights and custom reporting functionality Insights feature, which allows any Expensify member to easily monitor all aspects of company spend across categories such as employees, projects, departments, and subsidiaries.

General

Curious for a high level overview of EXFY? You've come to the right place!

What makes Expensify different from other expense management and corporate card players?

There are hundreds of millions of businesses in the world, less than 0.1% of which use any online expense management tool. Eventually, we believe many are going online, and that this market is not mature; it's in its infancy.

That opportunity is too big to acquire using a business model with losses: at some point, you need to figure out how to make money while you grow. Expensify has a long track record of profitable (Adj. EBITDA) growth, even in difficult economic times (and these are the most difficult we've seen for a long time).

Expensify was early to recognize this massive opportunity and has focused on the goal of long-term, sustainable, profitable growth.

Expensify has a very different business model than most everyone else in the market and that affects just about every aspect of the business. Specifically, most of our customers have come "bottom up", meaning individual employees adopted Expensify and promoted it to their boss – which is the opposite of the "top down" business model employed by our competition. This enables us to address a much larger portion of the hundreds of millions of businesses around the world than the 0.1% of businesses the rest of the market has been able to acquire in the past 30 years – and do it at a lower cost of acquisition.

For insight into our CEO’s motivations and leadership style, please refer to our S-1, in particular the section: ‘Letter from our founder and CEO’.

What is in the secret sauce culturally at Expensify and how does it encourage innovation and first principle thinking?

At Expensify, we believe great things happen when talented, ambitious, but humble people collaborate today on the immediate overlap between their own lifelong ambitions. Even if our ambitions are different, so long as our immediate actions agree, we can jointly pursue them with a unity and enthusiasm. However, this inherent tension between unified short-term goals and divergent long-term goals must be recognized, as otherwise that tension can’t help but tear us apart. Accordingly, from the very start of this company we have held out two very basic rules to help govern that natural tension between action and restraint, to strive for the maximum benefit of immediate collaboration, while avoiding the destructive side effects of long-term conflict. These two rules are well known by everyone, and by themselves have provided a surprisingly robust framework for decision making and conflict resolution. They are:

Get Shit Done

Don’t ruin it for everybody else

All employees have the freedom to work on what they consider to be the most important and valuable use of their time in any given moment, however, we expect that all decisions must tie back to and satisfy these two rules.

Why is Expensify’s business model so hard to copy?

This business model depends on three things that are each very hard to copy and very challenging to retrofit into an existing company:

Blockchain Technology. Expensify has a completely unique Blockchain-based database that operates on a cluster of extremely large (384 CPU) servers. This radical foundation allows employees to sign up before their bosses, because everyone is in the same giant database (versus split between different databases for different companies).

Viral Payments Engine. Expensify is not a single niche solution adopted inside the walls of one company at a time. Expensify has invoicing, billpay, and consumer collaboration flows that lead users to promote Expensify to their vendors, clients, and friends through the mere nature of using the product. This generates high quality leads, at scale, for free, dramatically lowing our cost of customer acquisition.

Employee-First Brand. Expensify has a brand that resonates with employees, who are the first to discover us and promote us to their bosses. This brand emphasizes the productivity concerns of actual end user employees, rather than just hammering on the same compliance concerns of the boss. Check out our SuperBowl Ad to see what we mean!

The DNA of Expensify is fundamentally different than our competition, affecting every aspect of the business, making our business model very hard to copy.

Who are Expensify’s main competitors?

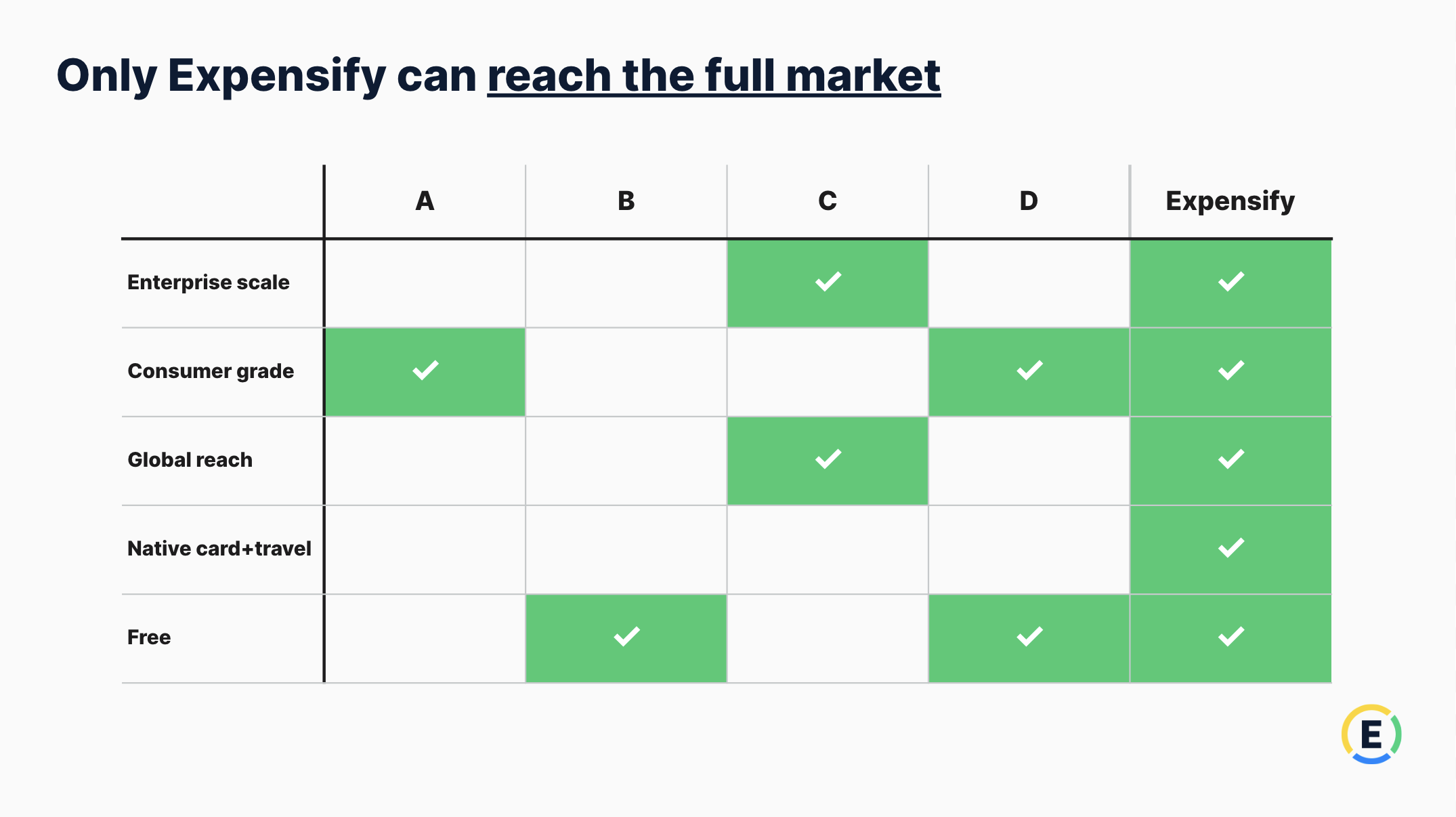

There are hundreds of millions of businesses in the world. 100% of those need to manage their expenses, but 0.1% of which actually use an online Travel & Expense (T&E) solution to do so. Accordingly, Expensify's main competitor is manual processing, aka using Excel Spreadsheets & holding onto paper receipts. And Excel isn’t fighting back. But if you are looking for a more traditional answer, we feel that we are competitively positioned within the market of traditional T&E competition, and we are the only solution that has enterprise scale, consumer grade design, true global reach, integrated card and travel – and offers all that, for free.

Are you seeing competition intensify on your end?

We’ve always seen competition, having been in the business since 2008. Competition pops up all the time, and we feel that corporate card players are the next wave. We feel well positioned, having a software first solution with a competitive corporate card feature. From what we’ve seen, our competition has done well cross-selling their card solution to their current customer base. As we've mentioned, one special aspect of Expensify is our bottom up model. We feel there is no amount of sales people that can close a billion users. We have aspirations to do just that, and we believe the only way to do that is with an established viral bottom up business model like Expensify.

How do you compete with other full-featured back office solutions?

The current trend in the back office is for customers to consolidate financial operations onto a single platform. This is a relatively new phenomenon, and the weakness of the technology market has created a lot of buying opportunities. This has resulted in the creation of multiple "full suite" options -- some built in-house and some built through acquisition. Expensify competes with these platforms by offering the most seamlessly integrated experience, as a result of our unique design of having a single "universal payments engine" that powers all these use-cases (as opposed to there essentially being a wide collection of different products loosely integrated in the UI). This results in a product experience that is easier to use, faster to deploy, and at a substantially lower cost to the customer.

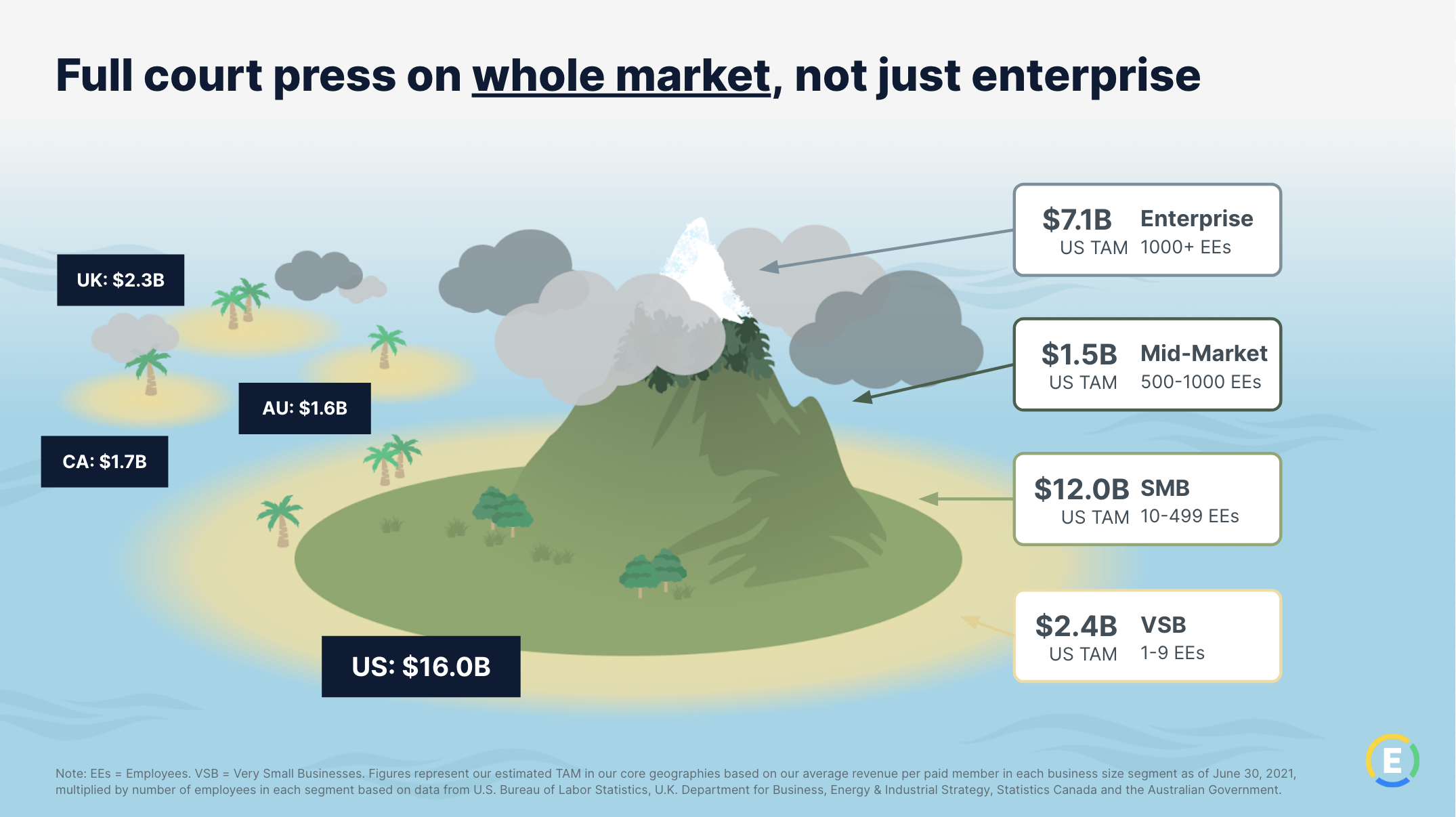

What is the total addressable market for Travel & Expense?

Below is an illustration we feel best represents the total addressable market for expense management.

What are Expensify’s customer segments by revenue?

Expensify does not experience customer concentration. No single customer contributes to greater than 1% of Expensify’ Revenue. Our customer segments, ranked in order by revenue, are as follows:

10-99 Employees

100-500 Employees

500+ Employees

3-9 Employees

1-2 Employees

How does Expensify sell to so many customers?

We have acquired our tens of thousands of customers mostly using an extremely efficient, high-velocity sales model that emphasizes self-service at every turn. There are as many variations upon this flow as there are customers, but a typical flow would look like this:

Employees learn of Expensify from a friend via genuine word of mouth (people love to complain about expense reports, and we are often presented as a solution), or perhaps from our out-of-home advertising, digital ads, or even TV advertising (including a SuperBowl ad!).

Employees download the Expensify app for free, without waiting to be asked by their boss, and without asking permission. They create their first expense report and submit it to their boss, turning their expense report into a highly targeted marketing message directly to the decision maker.

The decision maker approves the report and is prompted to create a free "policy" to manage expenses not just for the one employee who submitted, but all employees.

A natively integrated chat room is created for the decision maker to immediately start chatting with a setup specialist in real-time, or optionally set up a video call with a screen share to get personalized setup advice.

After adoption, the customer is migrated to an account manager for personalized long-term support.

At any point in time, the customer is free to fully configure their own account or lean upon the setup specialist or account manager to set it up for them.

Does Expensify do any outbound calling?

Yes, Expensify is in the early days of scaling a Sales Development Representative (SDR) team that directly buys lists and calls business owners and other individuals around the world to generate leads directly. This is an entirely new program, very few of our historical customers have been acquired in this way.

Why has the GTM needed to evolve over past 6-9 months with hiring of SDR group for more leads given the size of the freemium business?

We analogize our growth trajectory to a sailboat, and viral bottom-up acquisition is our sail. Under normal macro-economic conditions, the sail performs its function and steers our growth trajectory. However, we have not been in normal macro-economic conditions for some time - so, we are laying on a sales function to act as the motor to our sailboat. Our team of SDR’s, Account Managers, and Partner Managers will help steer our growth trajectory until normal macro-economic conditions return, at which time we believe our growth trajectory will be that much stronger, powered by both a sail and a motor.

Is Expensify well-suited for Enterprise?

Expensify has numerous enterprise customers, some examples of which are given here. We support public and multinational companies alike. However, we’ve found that we earn 5-10x more per user in the SMB than you can in the enterprise due to a lack of competitive price erosion, so our core market is very lucrative. If and when an RFP comes our way for an Enterprise client, we handle accordingly, however, we are not in the business of seeking out enterprise clients and fighting over slim margins.

What does Expensify need to do to be able to be a broader expense platform for mid-sized businesses?

Expensify is already very well suited to our mid-sized business customers with functionality such as:

Robust integrations with mid-sized ERPs like Netsuite and Sage Intacct

Custom export file for all popular mid-sized ERPs like Microsoft Dynamics, Oracle etc.

Integrations with traditional mid-sized corporate card providers like American Express.

Expense Auditing and policy compliance

Dynamic multi-layered approval workflow and custom logic

Global Tax tracking

Additionally, our plans to launch Global reimbursement functionality soon will help us to better serve our mid-sized business customers who often have operations in multiple geographies.

What is your international exposure?

In 2022 less than 10% of our revenue came from outside the US. We do not intend to break out more detail on international customers until this grows above 10%.

Product

Want to know what we do and for whom? Read on!

What does it mean to be a "preaccounting superapp"?

We describe ourselves as a "superapp" because we aren't a suite of linked products – we are one product that does all things preaccounting. Specifically, the one Expensify app can do all of these:

What is "preaccounting"?

Loosely speaking, preaccounting is all the accounting work done by non-accountants. Preaccounting consists of all the work employees do to book travel within predefined travel policy, make purchases on the road, capture receipts for those purchases, code and submit expenses for reimbursement, review and approve those expenses, and ultimately reimburse them and export to the accounting system… where the real accounting fun starts. Preaccounting is the collaborative workflow process of preparing all of an organization's financial data into a single place (the "general ledger") for the accountants to do their work.

Which of those features account for the most revenue?

All features are rolled into a single "active seat" pricing model, so it's not possible to break out revenue on a per-feature basis. However, our ability to manage and reimburse expenses is overwhelmingly our most popular feature, followed by our corporate card. The rest are popular within certain niches, but should be more as future opportunities than current revenue drivers.

How does Expensify’s pricing work?

There are two major plans: Collect and Control, which start at $5 and $9 per active employee per month, respectively. Most of our customers are on the Control plan. To get the $9 price point, you must put at least 50% of your approved spend on the Expensify Card, and also make an annual commitment. If you choose not to use the card, the price is doubled. If you choose not to make the annual commitment, it's doubled again. This results in a wide range of price points based on plan, card adoption, and commitment level. Nearly all revenue is billed to a credit card at the start of each month, with a small fraction paid by invoice. More details on this are on our Pricing Page.

What is the difference between "pay-per-use" and "annual" subscriptions?

Pay-per-use plans allow customers to use Expensify month-to-month with no commitment at a much higher (2x) price point. Annual subscriptions are still paid month to month but involve a minimum commitment on active user seats and also a contractual duration of 12 months. Most customers have a mix of annual and pay-per-use subscriptions. For example, a company that commits to 10 annual seats will pay $90/mo as a base, and in months where they have 5 extra pay-per-use seats at double the price, they will pay an additional $18x5=$90, for a total of $180.

What is the revenue split between “pay-per-use” and “annual” subscriptions?

Most customers have a steady baseline of annual seats at a reduced price, with a rapidly expanding/contracting set of pay-per-use seats on top of that at double the price. Pre-COVID, only a small, relatively steady fraction of our revenue came from pay-per-use. But macro volatility in the past couple years has created anxiety in our customers, which has translated into a greater dependence on pay-per-use seats. This is good in a way, as they pay a 100% premium for that flexibility. But it's problematic for the predictability of our revenue because these seats are extremely unpredictable, and have an outsized influence given their doubled price. To restore predictability to our revenue we have rolled out an account management organization to individually engage with each of our customers, with a key mandate to get them to migrate their premium pay-per-use seats to lower-cost, but more predictable annual seats.

At what price point do you think you have increased risk of an internal system being made?

A majority of our revenue comes from SMBs, so we’re competing with Excel in most cases. Excel is only free if your employee time is worthless. Especially in an economic climate where businesses are focused on efficiency, reverting back to Excel makes employees less efficient. In the Enterprise we do combat ERP systems that include discounted expense management and other solutions however we feel our solution is far superior and we are not focused on the Enterprise.

What is the estimate on people who submit expenses manually who need to move to automated?

There are 300 million businesses in the world. Not every business has revenue, but all have expenses. About 0.1% of those businesses currently use any automated solution. We believe 100% should and inevitably will, and whoever can capture them can create a business 1000x larger than any expense management business today. We think our differentiation is that we have a business model designed to go after that untapped 99.9% of the global opportunity, whereas everyone else is just fighting over the same 0.1%

Strategically, why is chat such a big part of the product strategic and part of the product roadmap?

At Expensify, we believe that every payment is a conversation and that financial collaboration is core to our future. Expensify Chat is therefore designed to be used for so much more than just expenses -- it is also a platform for daily conversation. Indeed, if we do this right, there should probably be exponentially more chats than actual expense requests. Chat results in more user acquisition, more existing company utilization and viral word of mouth which feeds our bottom-up adoption model.

Financial

When it comes to financials, there are as many possible questions as there are grains of sand on a beach. But the most common questions are below:

What were FY'22 results?

For all the gory details, please consult our official 10-Q.

Why is interchange reported as a contra-expense, and not as revenue?

We are working to reclassify interchange as revenue moving forward, which would better align with everyone's intuitive expectations. As discussed on our Q3 earnings call, our new card program will begin in Q1 2024. Cards issued under the new program will receive a different accounting treatment in which interchange is categorized as revenue. We plan to migrate all card customers to the new program by the end of Q4 2024

Why is cashback treated as contra-revenue, and not an expense?

Similar to above, it's a complicated accounting treatment relating to the precise nature of the agreement between Expensify and Marqeta. But this is also being re-evaluated, and might change.

How do you remain profitable in the current environment?

We have been a very profitable company, on an Adjusted EBITDA basis for a very long time. More recently, to adapt to the more challenging economic environment, we have been using this healthy margin to invest in our contributor programs across Sales, Engineering and Customer Account Management which directly drive paid user growth and retention. We also hosted ExpensiCon in May 2023 and recently launched a 0.5% revenue share with our ExpensifyApproved! accounting firm partners to strengthen our dominance in this channel. We view these higher costs as strategic growth investments which will directly drive paid user growth now and in the future. We’re already started to see the return on some of these in the short term (for example, the onboarding Guides program now pays for itself). Despite these investments we remain (non-GAAP) profitable and it is our intention to remain so, while continuing to make strategic investments in our user growth.

What is your LTV/CAC ratio?

This is not a metric we track, nor think others should because it’s not how our business operates. We’re a bottom up, viral acquisition model that is driven through product led growth. We build features that enable more growth. That is and will continue to be the core of our business model. To track and post an LTV/CAC ratio suggests that we are primarily a coin operated business where we would use $V dollars of marketing to generate W leads that would be converted by a sales team that costs $X and who generates $Y of revenue on average for Z years. Yes, we have these facets of marketing and sales in our business but our primary growth drivers are to build a free product that employees adopt and then bring us to their businesses who then adopt us and continue to grow and generate more revenue each year. With this model there is not an LTV/CAC ratio that we believe is useful. We’ve tried for years to define it because this is a common question and on top of our efforts hundreds of investors have spent countless hours trying to back into one as well. But every time is the same result, it comes out to just not being applicable to our model so we don’t post it and would suggest you not think about our business like that.

Why do you buyback shares?

The company has no near-term plans to buy back shares. We plan to update the market when future buybacks can be expected.

What guidance can you give on our future results?

We have over a decade of data showing that under normal, non-recessionary conditions, our organic business model has the potential to grow top line revenue between 25-35% per year. However, due to a variety of macro conditions that haven't yet settled, we are not in normal conditions. That said, even though it doesn’t look like the economy is going to improve in the near term future, we expect to grow revenue and continue to add paid users over the long term.

What needs to go right to hit the high end of that 35% growth?

Prior to the drastic change in the economic climate, we were able to achieve that level of growth sustainable for years. We believe this growth is achievable and sustainable when the market stabilizes. In the meantime, there are a number of helpful initiatives underway to improve results in these challenging market conditions:

Our sales organization has recently moved from a "transactional" model to a "dedicated" model, where a single salesperson engages with the lead from start to finish over chat.

Our account management organization has similarly adopted a "dedicated" model to not only provide enhanced care, but also focus on moving customers from pay-per-use to annual subscriptions, to reduce volatility.

The product roadmap has a number of features like chat and P2P payments that drive zero marginal cost lead generation.

The product roadmap also has features like chat and payroll that can potentially meaningfully increase the number of active seats (and thus revenue) from existing customers by up to 3x, recognizing that only a third of the company files an expense report every month, but everyone in the company chats with each other and gets a paycheck.

Why don't you give quarterly guidance?

Expensify's organic business model scales efficiently and profitably, but not predictably. In particular, the use of "pay per use" seats (also known as "overage" seats) results in a significant amount of "frothy" revenue on a monthly basis that is impossible to predict, as it's entirely a reflection of macroeconomic factors that are completely out of our control. Accordingly, giving short-term quarterly guidance is an exercise in trying to predict the next war, pandemic, or economic disaster. Accordingly, the whole company is focused on delivering long-term returns without short-term distraction, and our guidance reflects our focus.

How does this landscape change your capital allocation strategy with being able to grow while scaling margins?

We deploy capital in order to grow in a responsible and efficient manner. We do not spend just to spend. We remain focused on executing our long-term strategy without distraction from the current slow down in the economy. Of course, a slower economy does mean businesses in the SMB do not add employees or travel as much, which does slow down our bottom up model a bit. However, we believe we are well positioned as a company with healthy margins during these uncertain times. One thing we’re currently doing is putting in place additional growth levers like SDRs, sales reps, and account managers to further increase our organic, bottoms up growth.

What do you think about retention going into CY23 as the SMB market softens and downgrades?

Retention is always top of mind for Expensify. We spent the later part of 2022 and the beginning of 2023 rollout account managers to almost all customers in terms of revenue. We had good retention comparatively to others in this market, but we do feel the addition of account managers will be a big addition and hopefully improve retention despite a possible rough year for SMBs.

What causes volatility in your results?

Our volatility is generally a consequence of pay-per-use seats being unpredictable. To create more stability and predictability to these numbers, we are actively migrating customers off of pay-per-use plans onto annual plans by using price discount and sales incentives. Historically we've had about 20% of our customers on pay-per-use seats, which we think reflects a high degree of business confidence in near-term stability. Currently we are closer to 30%.

How does Expensify think about balancing long term interests of shareholders with the long term interests of the business given the governance structure?

We view those two interests as one in the same. We believe we have a governance structure that results in our employees, management, and board being strongly aligned with the interests of our shareholders. One of the keys to this alignment is our long term share class. For more information on this, please refer to our FAQ on our long term share class.

Which are the “input metrics” the team is focused on when assessing underlying trends in the business?

Paid members and interchange are our two main growth metrics. As discussed on the latest earnings call, we are currently focused on increasing the % of users who are on an annual subscription vs. the Pay Per Use plan. Our volatility is generally a consequence of pay-per-use seats being unpredictable. To create more stability and predictability to these numbers, we are actively migrating customers off of pay-per-use plans onto annual plans by using price discount and sales incentives. Historically we've had about 20% of our customers on pay-per-use seats, which we think reflects a high degree of business confidence in near-term stability. Currently we are closer to 30%.

What is Expensify’s long term share class and why would anyone want them?

We have two unique share classes: LT10s and LT50s (LT stands for Long Term). These shares are illiquid and generally require a long notice period before they can convert to common shares. An LT10 share requires a 10 month notice period before converting to a common share. An LT50 share requires a 50 month notice period before converting to a common share. The intention of this long notice period is to discourage employees from making short-term decisions at the cost of long term growth. Given the long notice period, it is challenging for management/employees to recognize their own personal wealth unless they build a strong and large business in the long term.

We require employees to have a meaningful percentage of their equity holdings in LT shares in order to be part of management in the company. Our people development (what externally would be seen as our mentorship and leadership track) program requires employees to have 10% of their equity in LT shares in order to participate in our mentor program. In order to be part of our “Top Tier” group (you can think of the Top Tier group as the “Senate” of Expensify where decisions on company’s direction and strategy are determined), employees are required to have 50% of their equity holdings in LT shares.

Prior to the IPO, we offered employees a one-time opportunity to convert their shares to LT shares. The response was an enthusiastic opt-in to this conversion. Over 50% of all shares held by all employees (including our executive officers) are in LT shares. Furthermore, we did a large IPO grant to all employees. This grant was in restricted stock units that vest into LT50 shares (and also in common shares that automatically “sell to cover” in order to pay for the taxes of the illiquid LT50 shares at vesting).

The impact of this is that our employees have large holdings in the LT share classes which means they are directly financially incentivized to create a successful business in the long term.

Additionally, we have stopped issuing common share grants to employees. We have an Employee Stock Purchase Program that is also designed to align employees with the long term interests of shareholders. 30% of an employee’s compensation is automatically put into the employee stock purchase program. If an employee keeps shares in the program and does not sell them, the program has a matching component where a portion of their shares are matched by the company. This means that employees are properly incentivized with equity, but with the added bonus of an additional incentive to not sell those shares and to hold them long term. This also aligns them with the shareholders in that they are incentivized to hold their shares long term while building a valuable company in the long term.

Housekeeping

If you are looking for basic company info, it is all right here!

Where is Expensify’s corporate headquarters?

Expensify is a global company headquartered at 401 SW 5th Ave, Portland, Oregon 97204, with global offices in San Francisco, London, and Melbourne.

Where is the company incorporated?

Expensify is incorporated in Delaware.

When did Expensify go public?

Expensify began trading on the NASDAQ stock exchange on November 10th, 2021.

When does Expensify’s fiscal year end?

Expensify’s fiscal year ends December 31st.

How is Expensify’s stock traded?

Expensify trades on the NASDAQ stock exchange.

Does Expensify pay dividends?

Expensify does not pay a dividend at this time.

Who is Expensify’s transfer agent?

Computershare

Whom do I contact with questions about my stock?

Investor Centre website

Telephone inquiries

1 800 736 3001 (US, Canada, Puerto Rico)

1 781 575 3100 (non-US)

Written requests

Computershare

P.O. Box 505000

Louisville, KY 40233-5000

By overnight delivery:

Computershare

462 South 4th Street, Suite 1600

Louisville KY 40202

web.queries@computershare.com

Shareholder Online Inquiries

Who is Expensify's auditor?

Ernst and Young is Expensify’s auditor.

Where can I find out more about Expensify?

Where can I get the latest corporate news releases and financial reports?

You can view our corporate news releases and financial reports on our News Releases and Financial Reports pages respectively.

How can I view documents Expensify has filed with the Securities & Exchange Commission (SEC), including Forms 10-K and 10-Q?

You can view all filings on our SEC Filings page.

Whom should I contact regarding investor inquiries?

Please contact investors@expensify.com regarding investor inquiries.

How can I obtain further information or materials on Expensify?

Visit we.are.expensify.com or use.expensify.com for more information or email investors@expensify.com with any questions.

Forward-Looking Statements

Forward-looking statements in this FAQ, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements regarding our long term prospects. As a result, our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “shall,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” “goal,” “objective,” “seeks,” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: the economic, political and social impact of, and uncertainty relating to, the COVID-19 pandemic; the war in Ukraine, and the conflict in Israel, Gaza and the surrounding areas, and the resulting escalating geopolitical tensions; our expectations regarding our financial performance and future operating performance; our ability to attract and retain members, expand usage of our platform, sell subscriptions to our platform and convert individuals and organizations into paying customers; the timing and success of new features, integrations, capabilities and enhancements by us, or by competitors to their products, or any other changes in the competitive landscape of our market; the amount and timing of operating expenses and capital expenditures that we may incur to maintain and expand our business and operations to remain competitive; the sufficiency of our cash, cash equivalents and investments to meet our liquidity needs; our ability to make required payments under and to comply with the various requirements of our current and future indebtedness; our ability to effectively manage our exposure to fluctuations in foreign currency exchange rates; the increased expenses associated with being a public company; the size of our addressable markets, market share and market trends; anticipated trends, developments and challenges in our industry, business and the highly competitive markets in which we operate; our expectations regarding our income tax liabilities and the adequacy of our reserves; our ability to effectively manage our growth and expand our infrastructure and maintain our corporate culture; our ability to identify, recruit and retain skilled personnel, including key members of senior management; the safety, affordability and convenience of our platform and our offerings; our ability to successfully defend litigation brought against us; our ability to successfully identify, manage and integrate any existing and potential acquisitions of businesses, talent, technologies or intellectual property; general economic conditions in either domestic or international markets, including the societal and economic impact of the COVID-19 pandemic, and geopolitical uncertainty and instability; our protections against security breaches, technical difficulties, or interruptions to our platform; our ability to maintain, protect and enhance our intellectual property; and other risks discussed in our filings with the SEC. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above. We caution you not to place undue reliance on any forward-looking statements, which are made only as of the date of this FAQ. We do not undertake or assume any obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

About Expensify

Expensify is a payments superapp that helps individuals and businesses around the world simplify the way they manage money. More than 10 million people use Expensify's free features, which include corporate cards, expense tracking, next-day reimbursement, invoicing, bill pay, and travel booking in one app. All free. Whether you own a small business, manage a team, or close the books for your clients, Expensify makes it easy so you have more time to focus on what really matters.